The Data Center Chimera

How Good Business Opportunities Go Bad

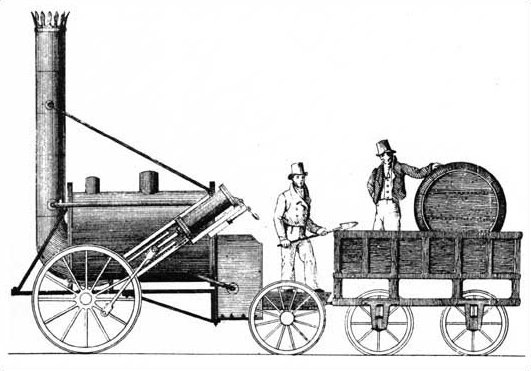

In the 19th century railroads were the business to get into. They were guaranteed a return, because no one had ever been able to move people or goods like that before.

But the English railroad boom faded quickly. Once the roads were in operation, competition drove prices down. Promised returns never materialized. It was bad for investors but glorious for the economy. England became a small island, because you could get from Manchester to London in a few hours, rather than spend a week either bouncing behind a horse or hoping for a favorable wind.

It was different in America. The country was bigger. Railroad companies figured out that once one line went out to Ottumwa, Iowa, it was wasteful to build another. After the Civil War, railroad companies squeezed farmers and other producers dry, high rates turning farm profits into losses. The Populist uprising, and the Progressive movement, were direct outgrowths of this. Monopoly rates would be regulated, and new monopolies were created, in transit, power, and telephony. It was all about using scarce capital efficiently.

Today, data centers are “the new hotness.” Cloud czars, wannabes, and private equity are building warehouses as fast as they can, shoveling Nvidia racks into them. They’re taking up the land and sucking up the power. What seemed like a good deal to voters a decade ago now doesn’t look that good to them. It’s a new Populist uprising, folks fighting for their property values instead of their farms.

But has anyone thought of what comes next?

The Internet is Olde England

Data centers aren’t monopolies, unless they’re attached to a service provider like Meta or Google that guarantees their cash flow.

The situation is a lot more like early 19th century England than late 19th century America. Once most data centers are in operation, everyone will compete with everyone else. This will be great for AI providers, who will be able to arbitrage among data centers to meet their needs, as they arbitraged fiber lines a quarter century ago.

Nvidia will also be continuously making these data centers more efficient. I wrote about this just a few weeks ago. Nvidia will eventually meet demand in this space, leaving data centers to compete for business. Those using more water and more electricity, like those using Hopper chips today, will have higher costs than those using whatever replaces the new Rubin chips. This is the promise of Huang’s Law.

Once you’re on the Internet, at Internet speeds, everything on the Internet is next door. It makes no sense to put data centers near data customers instead of by sources of power and water, but that’s not my business.

The point is that the data center business will become more akin to England’s early railroads than America’s later ones. Once these things are operating, they’re not going to be very good businesses because they will lack pricing power. They also won’t create much ongoing employment. That’s the way they are.

It seems there is precedent for almost everything in this crazy world of ours. When the data centers start threatening to go broke, however, let them eat chips.